As unemployment in the labor pool rose, so did the requirements for education and experience from employers. What was portrayed by Chamber of Commerce and economists as a ‘skills gap’ was the consequence of high unemployment, not the cause.

Returns on Capital to Labor and Higher Costs?

Although some analysts warned of inflation, Ms. Girard said the pay increase should not bother policymakers at the Federal Reserve. “I don’t think it’s something the Fed should worry about,” she said. “Productivity growth is picking up, and workers should earn more. It doesn’t mean companies have to pass on higher wage costs to consumers. They can afford to pay them more.”

Monopsony and Fed Up

Fed Up: Flat wages, below target inflation, rising EPOP—

Trade Wars Looking More Arduous Everyday

Jim Zarroli:

“China’s economy is much less dependent on trade now and on trade with the U.S. than it used to be,” says Linda Lim, professor of corporate strategy and international business at the University of Michigan.

“Trade is around 20 percent of China’s economy,” she says. “Ten years ago, it was 40 percent.”

At the same time, U.S. companies like Boeing, General Motors and Apple now make plenty of money in China’s vast consumer market, giving Beijing leverage over the U.S. economy that it once lacked.

Chinese bureaucrats could make life very difficult for these companies if they chose to, Ross says.

China is Better Able to Withstand a Trade War Than in the Past

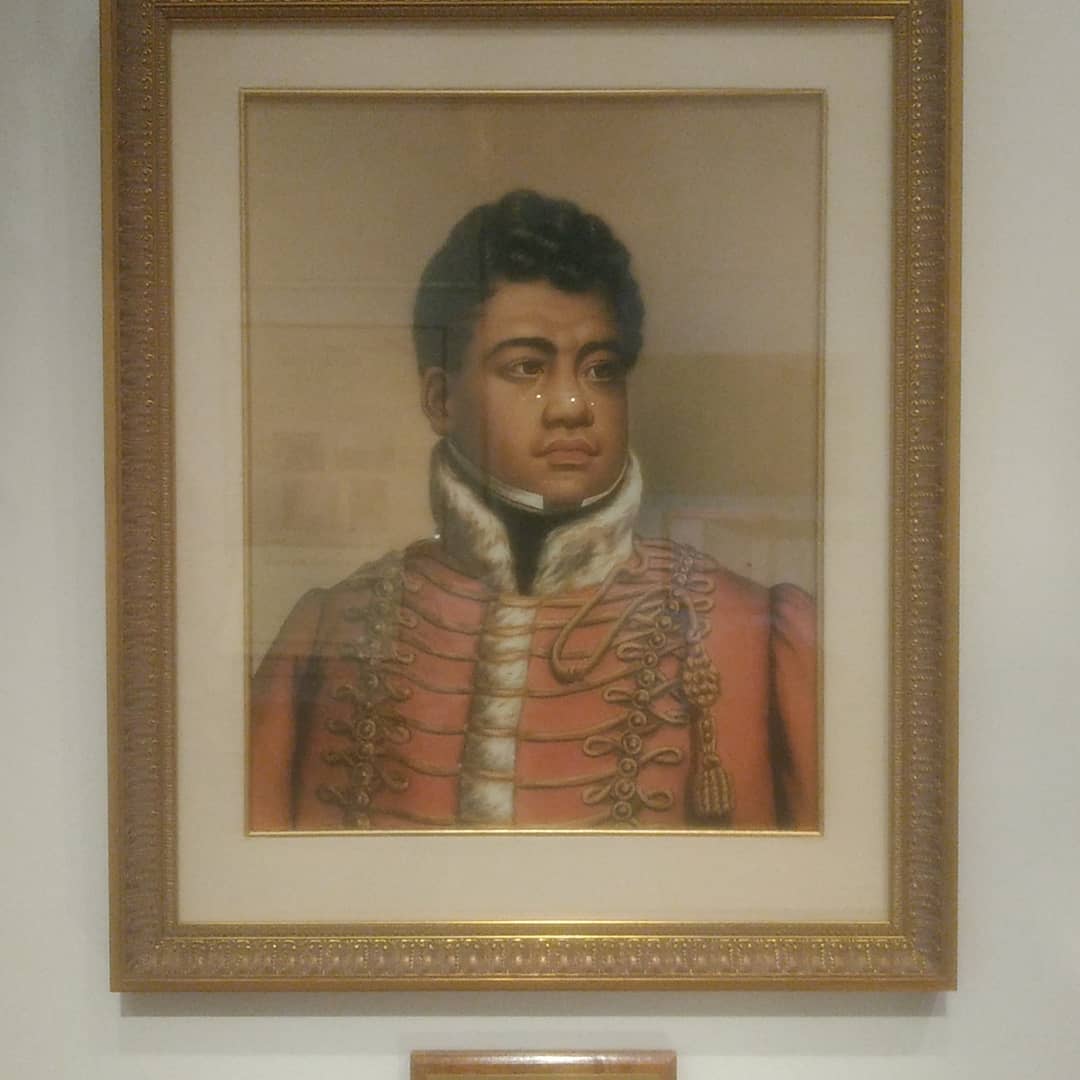

Oahu

Approaching Challenges with a Model

(1) Focus on High-leverage Activities — “Leverage should be the central, guiding metric that helps you determine where to focus your time.” (related: Eisenhower decision matrix — “what is important is seldom urgent, and what is urgent is seldom important.”, “The best time to plant a tree was 20 years ago. The second best time is now.”

Gabriel Weinberg’s blog has more mental models-.

Expected value – a simple model for evaluating uncertain events (multiply the probability of the event by its value).

Corollary: Sometimes you’ll have to estimate probabilities when it feels really hard to do.

Example: Chance of winning NY lotto is 1 in 292,201,338 per game. Let’s say the grand prize is $150M and ticket price is $1. Then the expected value is roughly $0.5. Since $0.5 < $1, the model tells us the game isn’t worth playing.

Warning: Looking at expected value often isn’t enough. You need to consider utility to make good decisions.

See also: Techniques for probability estimates, shut up and multiply, scope insensitivity.

More mental models from Slava Akhmechet.

The Web vs the Trinet

The 2018 elections are coming and our networks are still vulnerable to manipulation….

What has changed over the last 4 years is market share of traffic on the Web. It looks like nothing has changed, but GOOG and FB now have direct influence over 70%+ of internet traffic. Mobile internet traffic is now the majority of traffic worldwide and in Latin America alone, GOOG and FB services have had 60% of mobile traffic in 2015, growing to 70% by the end of 2016. The remaining 30% of traffic is shared among all other mobile apps and websites. Mobile devices are primarily used for accessing GOOG and FB networks.

Modular Housing as a Construction Alternative

A study from the Berkeley Terner Center on roughly 800 prefabricated housing units suggests that offsite construction could lend more housing at cheaper prices if it could be brought to scale:

The Case for Off-site Multifamily Construction

While a number of other countries such as Sweden have already broadly integrated off-site construction, only a few off-site factories are currently in operation in the United States. Today, the Terner Center is releasing a new paper exploring the benefits, barriers, and breakthroughs needed to significantly expand this construction method in the American market, particularly in the multifamily development sector. The paper documents the potential cost savings, time savings and other benefits of off-site construction, identifies some of the key reasons it hasn’t yet taken off, and puts forth several ideas for how to overcome these challenges to bring it to scale.

Tax Cuts and Labor Supply Elasticity

Dietrich E. Vollrath on why tax cuts don’t lead to growth:

We think that if you lower the tax rate, and hence raise the returns to inputs, we should get more of them. But to “supercharge” growth in GDP, or to have any appreciable effect on GDP at all, you need that the elasticity of that input supply with respect to those returns is really big.

For labor, there appears to be good evidence that this elasticity is in fact small. There is not some pent-up store of workers and human capital out there that is just a 35% tax bracket away from getting off their ass and going to work. This labor supply elasticity is found to be essentially zero in almost every case, with the exception of married women. You can see some citations on this in the review paper by Saez, Slemrod, and Giertz (SSG). With an elasticity close to zero, no matter how much you lower the tax rate, and raise the return to labor (i.e. the wage), you can’t induce a substantial increase in labor supply. And without a substantial increase in labor supply, you don’t get a big increase in GDP.

Continued….

The second thing reducing the impact of tax cuts on GDP is that taxes are not levied on only the transactions that are part of GDP, they are levied on all kinds of transactions. Think of the fact that every year there are billions (and maybe trillions) of individual transactions that take place in the economy. Some of those transactions involve payment for a real input like labor or capital, which means they are part of GDP. But some of those transactions are purely financial, and so are not [included in GDP]. But the tax code does not make this distinction; you are not taxed only on your transactions that contribute to GDP, you are taxed on all (okay, most) of your transactions where you receive some money.

Federal Deficits and Government Spending

Stephanie Kelton with an NYT editorial on why the deficit doesn’t matter, but the economy does:

The trick is to adjust the budget to make efficient use of the people, factories and raw materials we have…. But all of this goes unrecognized on Capitol Hill, where the very words “debt” and “deficit” have been weaponized for political ends. They serve as body armor to politicians who would deny resources to struggling communities or demand cuts to popular programs.

Mark Dow on the distinction between liquidity(i.e. the recent quantitative easing at the Federal Reserve) vs credit in banks– then, if reserves are not used directly to prop up the stock market, and if the Federal Reserve keeps yields low for the future to encourage people to put their cash to work, it would be safe to assume that the policy is working to keep inflation low; yet, my perception is that demand is weak and unemployment is higher than desirable(where’s the beef?):

The other, more mechanical, implication is that financial sector lending is neither nourished nor constrained by base money growth. The truth is the Fed’s monetary policy can influence only the price at which lending transacts. The main determinant of credit growth, therefore, really just boils down to risk appetite: whether banks and shadow banks want to lend and whether others want to borrow. Do they feel secure in their wealth and their jobs? Do they see others around them making money? Do they see other banks gaining market share?